Dealing with excess payments can feel frustrating, especially when trying to recover your money after an insurance-related issue.

Following the right steps makes the process straightforward. Here’s everything you need to know to navigate it confidently.

Key Points

- Excess is recoverable under specific circumstances.

- Reviewing policy terms is the first critical step.

- Fault determination heavily impacts recovery.

- Proper documentation is essential for success.

- Persistence ensures smoother outcomes.

What Is Insurance Excess and Why Does It Matter?

However, paying this amount upfront can be frustrating, especially when the situation isn’t your fault.

For tailored advice on selecting the right plan, consider reaching out to Audelio. They review the entire insurance market with a focus on your specific needs.

Unlike call centers, Audelio offers direct personal contact without frustrating delays, providing recommendations designed to suit individual requirements.

When Can You Claim Back Insurance Excess?

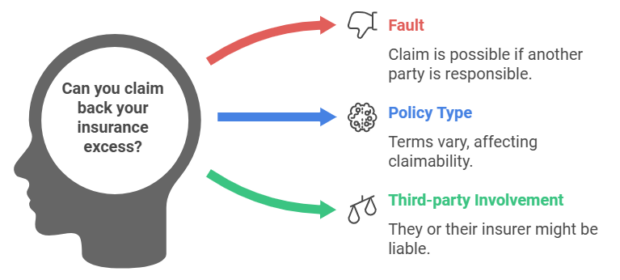

Factors influencing your ability to claim back include:

Fault: Recovery is usually possible when someone else is responsible.

Policy type: Terms vary between car, health, travel, or home policies.

Third-party involvement: If a third party caused the issue, they or their insurer might be liable.

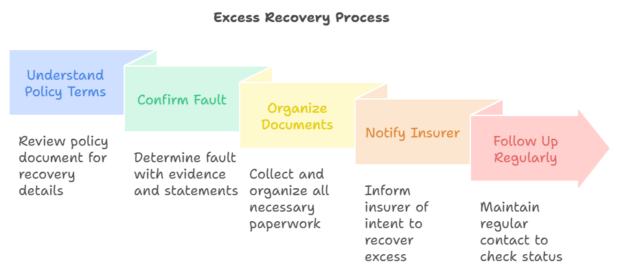

Step 1: Understand Your Policy Terms

Start by reviewing your policy document.

It contains crucial details about excess recovery, such as the specific conditions where recovery is allowed.

Look for clauses addressing:

- Circumstances of fault.

- Excess waiver provisions.

- Time limits for filing recovery requests.

Familiarity with your policy ensures you avoid unnecessary setbacks. If anything seems unclear, seek clarification from your insurer.

Step 2: Confirm Fault

Fault determination is one of the most important aspects of recovering your excess.

If the other party is responsible, their insurance may cover your costs.

Here’s how to confirm fault effectively:

- Gather all available evidence, including photos, videos, and police reports.

- Obtain written statements from eyewitnesses.

- Ensure your documentation aligns with the incident details.

- Proper evidence strengthens your case and prevents disputes from escalating.

Step 3: Organize All Required Documents

Missing paperwork can lead to delays or outright rejection.

Ensure you collect:

- The insurance policy details.

- Proof of excess payment, such as receipts or bank statements.

- Incident reports, including police or accident reports.

- Any correspondence between you and the third party.

- Keeping everything well-organized reduces back-and-forth exchanges with insurers.

Step 4: Notify Your Insurer

Outline your intention to recover the excess and provide supporting evidence.

Your insurer will inform you whether they handle the recovery on your behalf or if you need to pursue it directly.

If required to engage the third party, follow your insurer’s guidance closely. Maintaining clear communication at every stage ensures nothing is overlooked.

Step 5: Follow Up Regularly

Regularly check on the status of your case and provide any additional information promptly.

Effective follow-up shows insurers that you are committed and prevents your case from being sidelined.

What to Do When the Third Party Refuses Responsibility

Here’s how to handle such situations:

- Present irrefutable evidence, such as witness statements or surveillance footage.

- Seek mediation services to resolve disputes without escalating to legal action.

- Consider small claims court if mediation fails, ensuring your case has strong evidence.

- Third-party disputes are challenging but not impossible to resolve with the right approach.

What to Expect in Legal Proceedings

Excess Waiver insurance allows you to claim back your excess on any one insurance claim made during the 12-month period of your car insurance policy.

See how we could help you here – https://t.co/EsNUfK9NEw

— InstructorcoverPlus (@Instructorcover) May 3, 2022

Key points to remember include:

- Filing fees and timelines vary by jurisdiction.

- Strong evidence increases your chances of success.

- Legal assistance may be required for more complex cases.

- Weigh the potential costs and benefits before pursuing litigation.

How Long Does Excess Recovery Take?

The timeframe depends on several factors, including:

- The complexity of the incident.

- The insurer’s internal processing times.

- Cooperation from the third party.

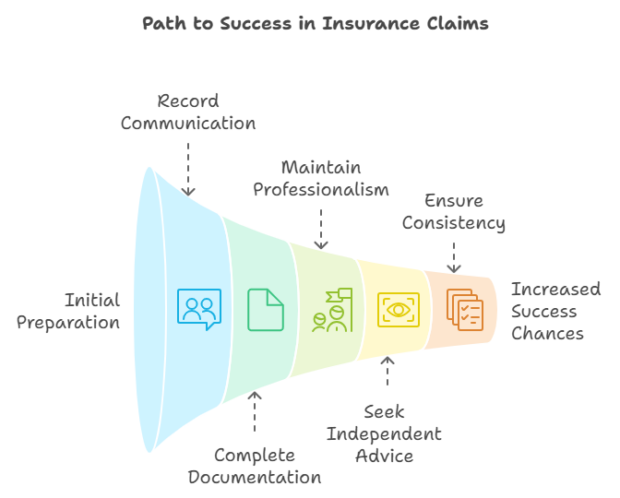

Tips for Improving Your Chances of Success

- Keep all communication records, including emails and call logs.

- Submit complete documentation from the start.

- Remain professional in all interactions with insurers and third parties.

- Seek independent advice if policies or procedures seem unclear.

- Consistency and preparedness often make all the difference.

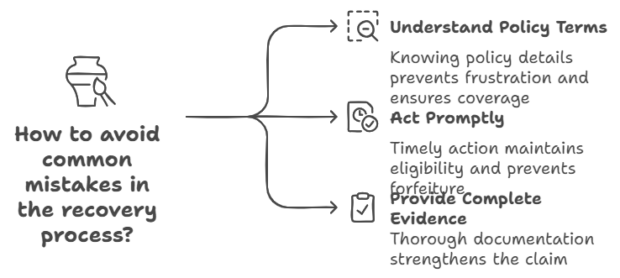

Common Mistakes to Avoid

- Failing to Understand Policy Terms: Skipping over policy details often leads to unnecessary frustration. Always know what your policy covers before starting the recovery process.

- Waiting Too Long: Excess recovery typically has strict time limits. Delaying action could forfeit your eligibility.

- Providing Incomplete Evidence: Incomplete or unclear evidence weakens your claim. Ensure all documentation is thorough and well-organized.

FAQ

Final Thoughts

Consistent follow-up and professional communication increase your chances of a successful outcome. Protecting your finances starts with understanding your rights and staying persistent.

Jewel Beat

Jewel Beat